Are insurance premiums increasing in 2021? Read an expert's opinion

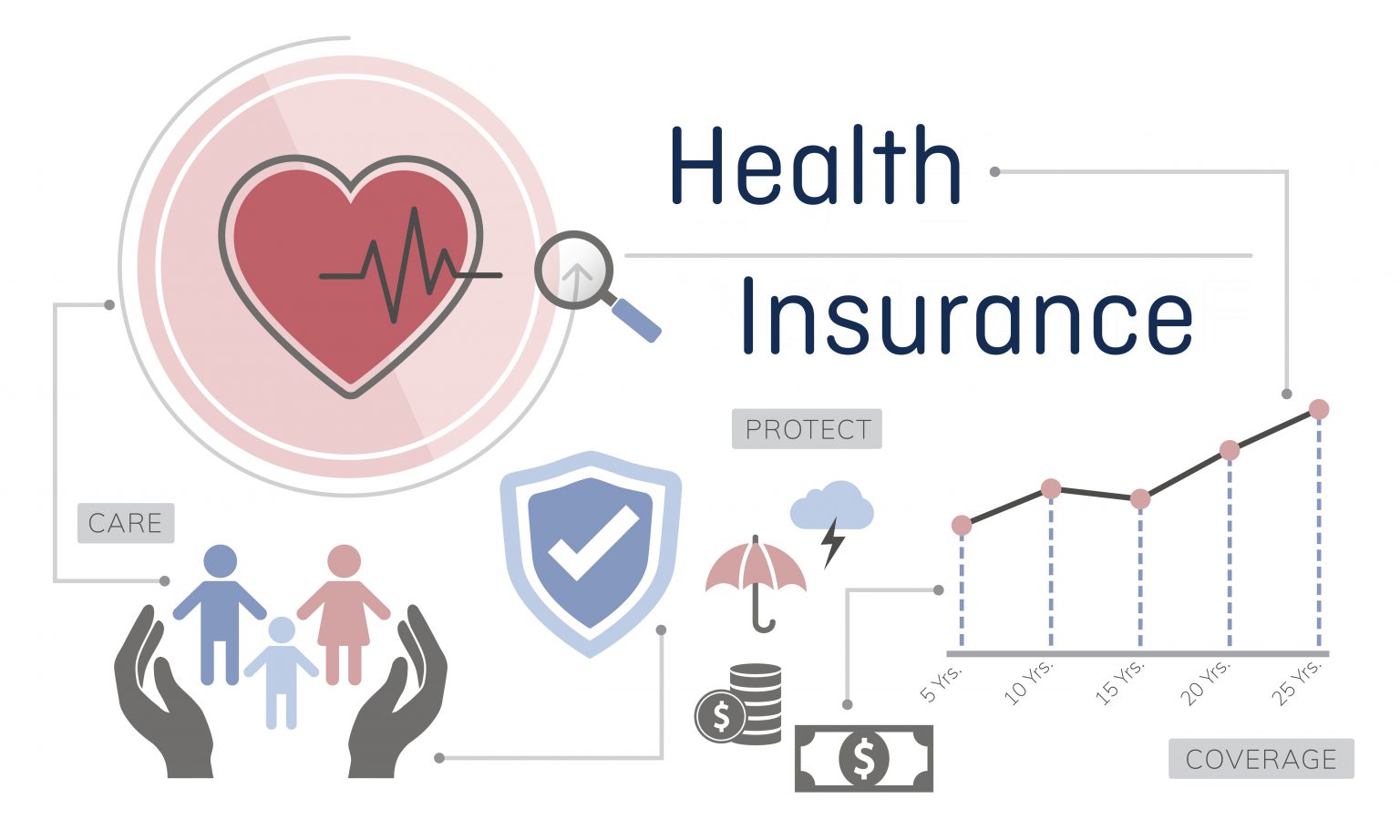

2/ Medical inflation. One of the most significant factors that can cause health insurance premiums to increase is the overall cost of healthcare. The cost of healthcare services, including doctor visits, hospital stays, and prescription drugs, continues to rise year after year. As a result, health insurance companies may need to increase.

4 Reasons Why Your Home Insurance Premiums Increased Harry Levine

November 09, 2016. If you're among the people facing substantially higher health insurance premiums with a plan set up under the Affordable Care Act, there are some steps you can take to limit.

:max_bytes(150000):strip_icc()/homeowners-insurance-guide_final-88e7d3469dcc4920977498f08564b234.png)

Homeowners Insurance Guide A Beginner's Overview

Your Credit Score. Auto-insurance companies have found that people with low credit scores are more likely than those with high scores to get into accidents, so they charge them more when they can.

What Is Insurance Premium Insurance Premium Definition, Meaning and

Here are things that insurers consider higher risk behaviors that could lead to an increase in your car or motorcycle premium: Getting a speeding ticket. Being involved in a car accident, especially if you were at fault. Being arrested for a motor vehicle offense, such as a DUI/DWI or reckless driving.

Have a look at these awesome pins and story to supply inclusions in

What factors affect the cost of homeowners insurance? The average cost of home insurance is $1,754 per year, but rates are on the rise due to rising construction costs, inflation, and an increase in natural disasters. Around 94% of homeowners saw their premiums increase from May 2022 to May 2023, according to our 2023 Policygenius Home Insurance Pricing Report.

Why Are Insurance Premiums Increasing? Glowsure Insurance Brokers

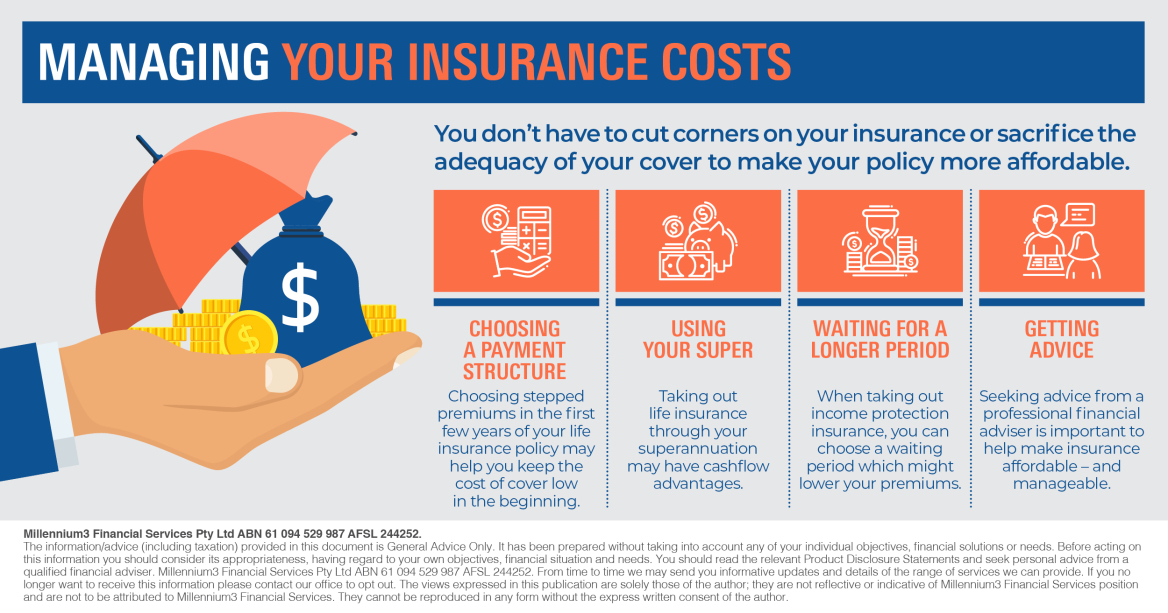

Many insurance companies offer discounts for bundling policies, which can lower your overall premium. For example, you can bundle your home and auto insurance with the same provider. Improve your credit score. Insurance providers use credit scores as a factor in determining premiums. A higher credit score can lead to lower insurance premiums.

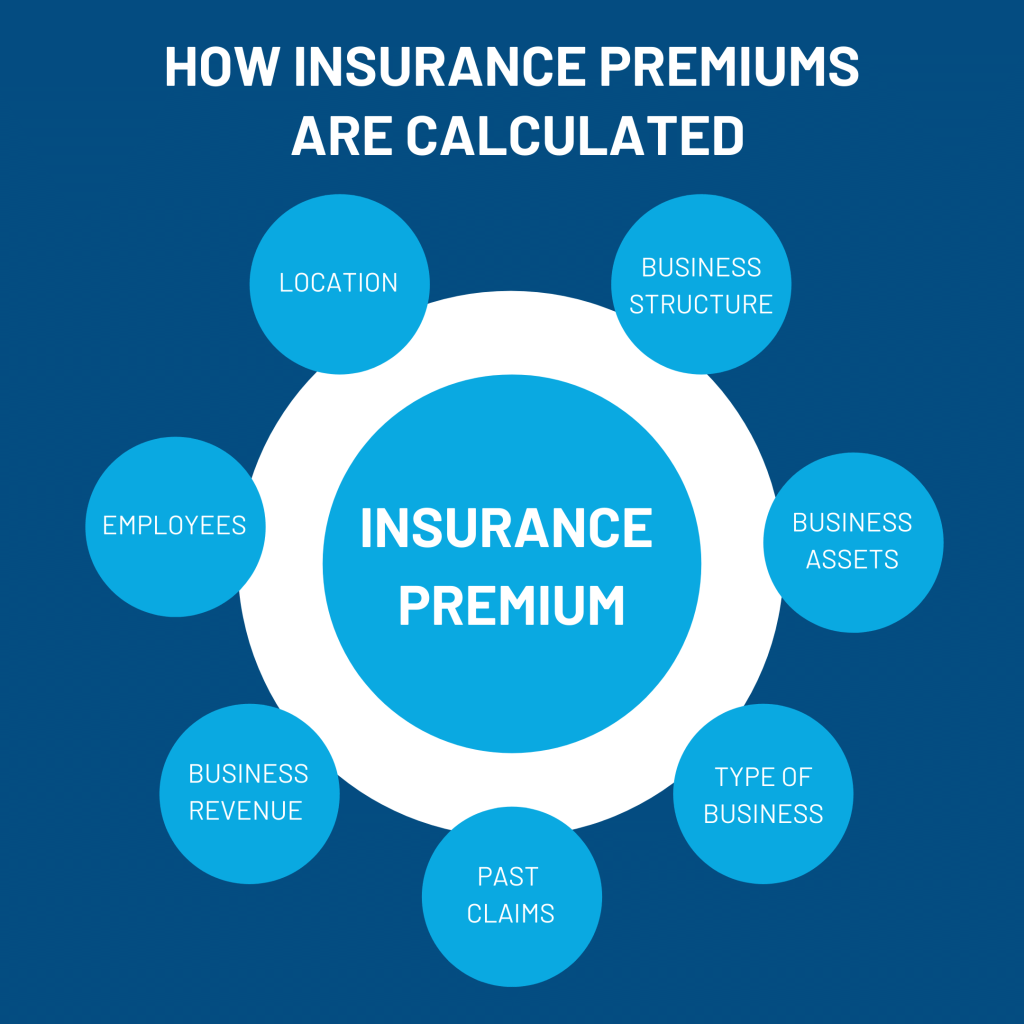

What Factors Increase Business Insurance Premiums 2022 The Coyle Group

10 Cheapest 2013 Car Models to Insure. 1. Your credit score. Auto-insurance companies have found that people with low credit scores are more likely than those with high scores to get into.

Your Health Insurance Premium is Likely to Increase from April, Here's Why

On average, insurance companies sought to raise homeowners' premiums by more than 11% last year, according to S&P Global Market Intelligence. Auto insurance premiums are climbing even faster, far.

What Can Cause Your Business Insurance Premiums To Increase? TCG

Health insurance premiums go up with inflation, but they also regularly increase out of proportion to inflation. This is due to a number of factors. New, sophisticated, and costly technology helps in the diagnosis and treatment of health conditions, while specialized medications can prolong lives from diseases like cancer.

9 Factors That Affect Your Insurance Premium Financial Knowledge and

According to Freddie Mac, the average annual homeowners insurance premium for a typical home in 2023 was $1,522. Premiums were 10.8% higher than in 2022 and 40.8% higher than in 2018. However.

Cause of Skyrocketing Insurance Premium Increases Wealth Management

Increased Vehicle Value. Another contributor affecting the auto insurance market: the value of most vehicles - both new and used - increased while supply decreased. As of September 2022, used car and truck prices were up 7.2% and new vehicle prices were 9.4% higher when compared to September 2021. 2. More expensive cars (and parts) also.

Why do health insurance premiums increase?

According to Quote Wizard, an unfair increase in premiums can happen if your insurance provider decides to change the priority of your credit rating. They may offer preferred rates to drivers with.

5 Essential Reasons Why Your Business Needs Insurance

For home insurance, your premium may go up if you make a claim or if there is a natural disaster in your area. There are a number of factors that might be the reason why your insurance insurance is going up. Some of the most common include: - A increase in the cost of insurance claims. - An increase in the number of insurance claims.

How to Manage Your Insurance Costs Roy A McDonald

At-Fault Accidents. One of the most common reasons for a car insurance rate increase is an accident where you're at fault. If someone files a claim to your insurance about an accident you caused, you can expect a boost in your monthly premiums. That said, there are some exceptions. Some insurers will allow for small claims of $500 or less.

EXPLAINED Why Do Auto Insurance Premiums Increase?

Driving Record. While it makes sense that your driving record would affect your car insurance premiums, it may come as a surprise that those moving violations can also bump up your life and health.

Why Health Insurance Premiums Increase INSURANCE INFORMATION

5 Top Reasons for Insurance Premiums to Rise. History of claims: One of the fastest ways to get higher insurance rates is to file many claims. When insurance companies see that an insured files claims regularly, they may increase rates to make up for higher expected future costs. Accidents and tickets: Moving violations and accidents where you.