Elliot Wave Theory A Complete Guide For Cryptocurrency Traders

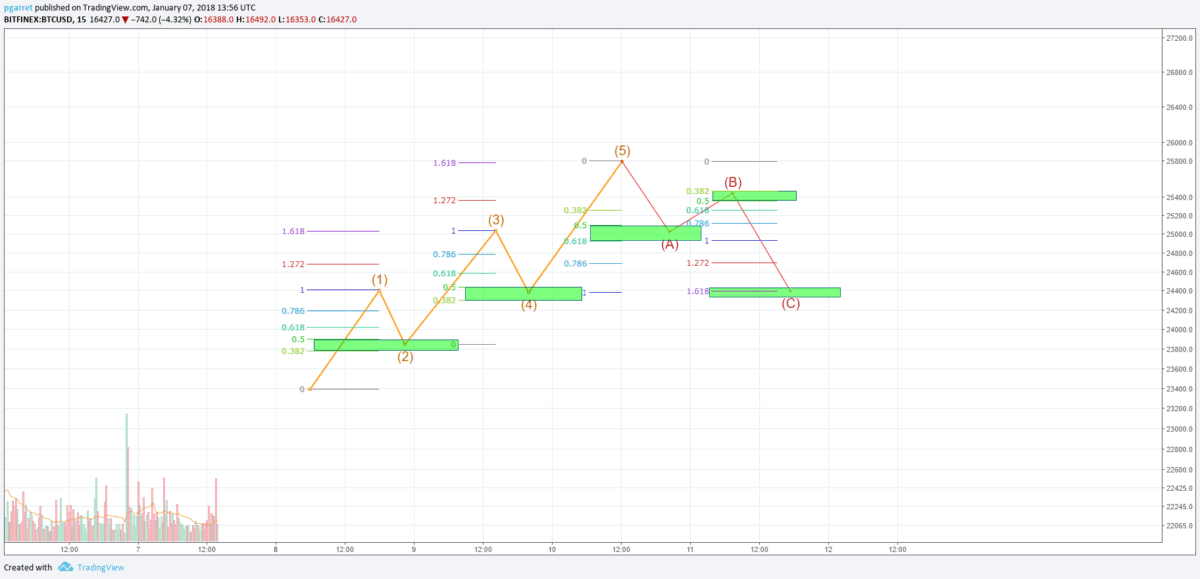

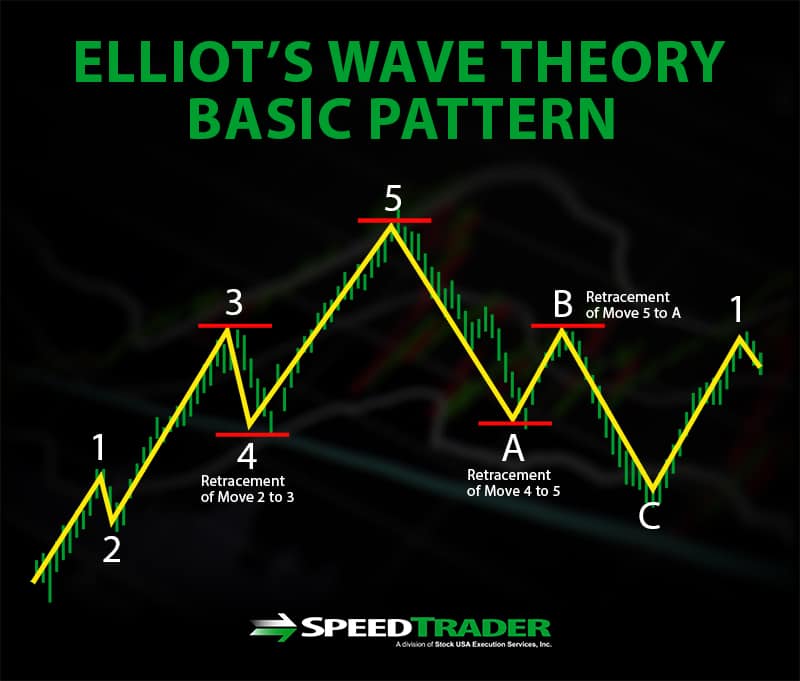

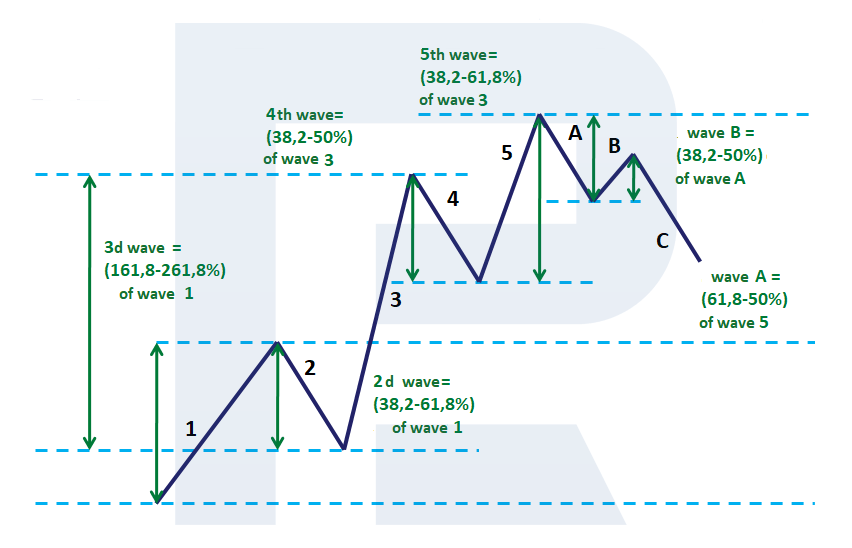

The three rules are: Wave 2 cannot retrace more than 100% of Wave 1. Wave 3 can never be the shortest of waves 1, 3, and 5. Wave 4 can never overlap Wave 1. The goal of a motive wave is to move the market. Out of all the various types of motive waves, impulse waves are the best at accomplishing this. The chart above shows an impulse wave.

Elliott Wave Cycle Detailed Explanation Sweeglu

What examples of successful Elliott Wave trades can be found? There have been several examples of successful trades using the Elliott Wave theory. Some notable examples include: Dow 2002/2003: In 2002, market analyst Robert Prechter correctly predicted that the Dow Jones Industrial Average would fall from its then-current level of around 11,000.

Visual Guide To Elliott Wave Trading UnBrick.ID

3. 2. Three main rules for impulse waves in Elliott Wave theory There are 3 main rules, which anyone who wants to make an Elliott Wave analysis must know. First rule: Wave 2 cannot retrace the whole wave 1. Second rule: Wave 3 cannot be the shortest among waves 1, 3 and 5. Third rule: Waves 1 and 4 must not overlap. See an example below: 3.3.

Elliott Wave's Cycle explained on Chart This chart is a perfect

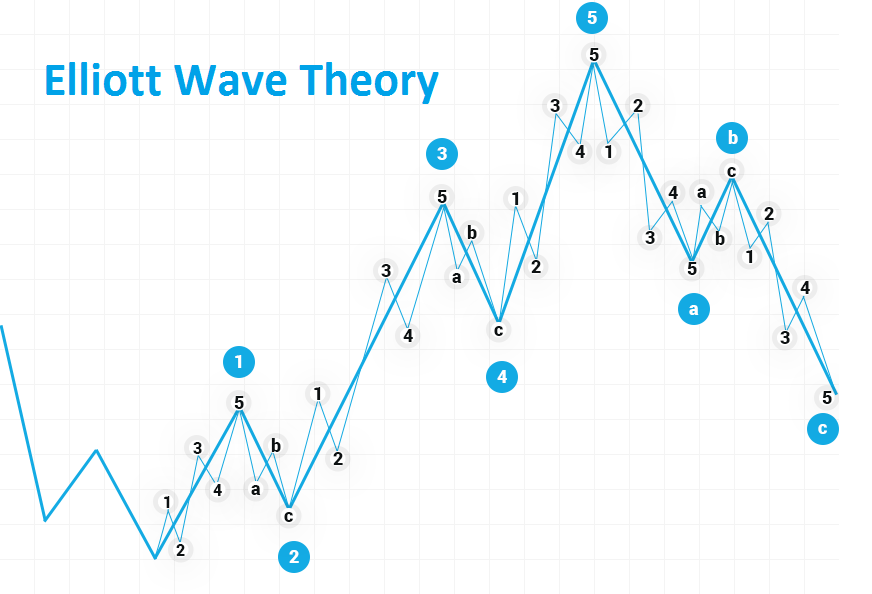

Here's the four types of Elliott Wave Corrective Patterns: 1: ABC ZIGZAG correction wave - 5,3,5 internal wave form. 2: ABC FLAT corrections - 3,3,5 internal wave form, regular and irregular types. 3: TRIANGLE ABCDE corrections - 3,3,3,3,3 internal wave form. 4: COMBINATION corrections - additive structure made from multiple simple corrections.

The classic Elliott Wave CastAway Trader

[1] Foundation The Elliott wave principle posits that collective trader psychology, a form of crowd psychology, moves between optimism and pessimism in repeating sequences of intensity and duration. These mood swings create patterns in the price movements of markets at every degree of trend or time scale.

Elliott Wave Theory Basic

3) Motive Waves 3.1 Impulse 3.2 Impulse with extension 3.3 Leading Diagonal 3.4 Ending Diagonal 3.5 Motive Sequence 4) Elliott Waves Personality 4.1 Elliott Wave 1 and wave 2 4.2 Elliott Wave 3 4.3 Elliott Wave 4 4.4 Elliott Wave 5 4.5 Elliott Wave A, B, and C 5) Corrective Waves 5.1 Zigzag 5.2 Flat 5.2.1 Regular Flats 5.2.2 Expanded Flats

:max_bytes(150000):strip_icc()/ElliottWaveTheory-b46a288b1cfe42c69bdbf3b502849b2c.png)

Elliott Wave Theory Definition

Here's a quick example of the model vs the reality: The Elliott wave model; A real 5 up 3 down pattern in GOLD; And a bearish 5/3 pattern in Crude oil; Also in this guide; I will go through how to use an Elliott wave pattern along with Fibonacci analysis in the forex market, the stock market as well as the commodities market! What you will learn;

Elliott Wave Pattern Candle Stick Trading Pattern

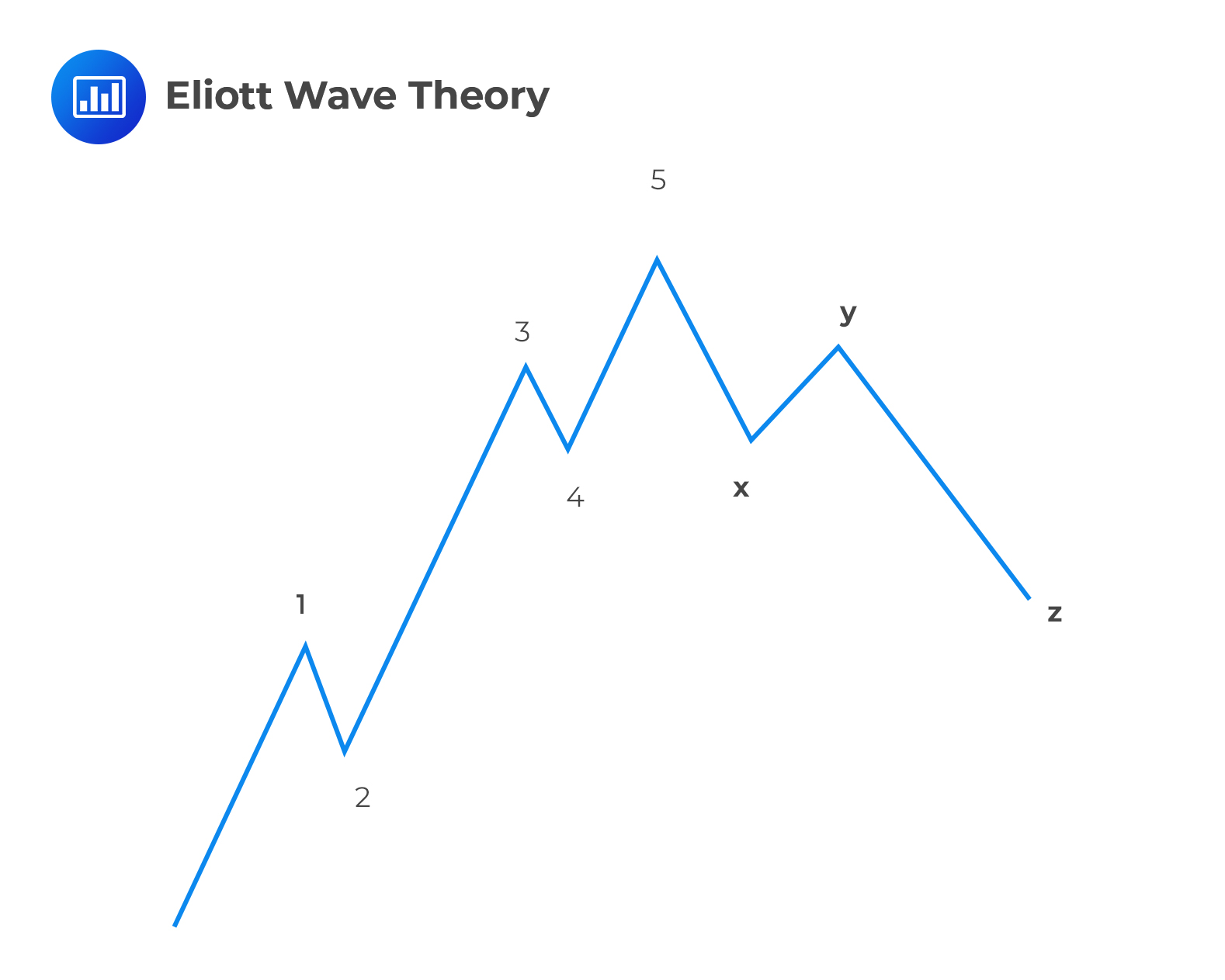

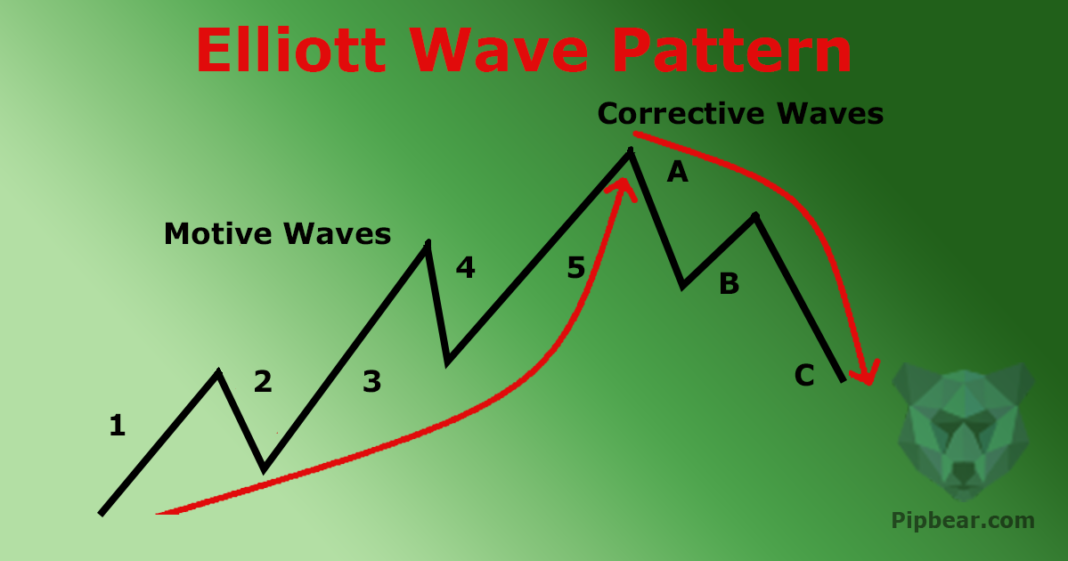

December 6, 2023 Elliott Wave Theory is a technical analysis indicator used to predict price movements in financial markets. It proposes that market trends move in a five-wave sequence in the direction of the main trend, followed by a three-wave counter-trend.

Elliott wave theory Example using actual Forex charts

The chart below shows an example of the Elliott wave. Basic structure of the Elliott Wave. In the naming convention of the Elliott wave theory, price tends to alternate between the impulse and motive waves. The impulse waves which move in the direction of the trend are divided into five lower degree waves. Typically, the waves numbered 1, 3 and.

The Elliott Wave Theory Explained CFA Level 1 AnalystPrep

In Elliott Wave Theory, the two types of waves in price movement are called "trend" or "impulse" waves and "consolidation" or "corrective" waves. Looking at a chart, a trader may attempt to define which wave cycle is underway, what recent waves have occurred, and—if the waves have been identified correctly—what wave is likely to occur next. Note

Complete Guide To Charting And Trading Using Elliott Wave Getting

After extensive study Elliott concluded that there are two different types of waves in financial markets: motive waves (or impulse waves) and corrective waves. An impulsive wave appears in the same direction as the main trend and usually has five waves within the pattern.

/elliott-wave-tricks-to-improve-trading-4153295_FINAL-3500ecb730a84818b040c75f73a1fa98.png)

Elliott Wave Tricks That Will Improve Your Trading

Amanda Jackson What Is the Elliott Wave Theory? The Elliott Wave Theory in technical analysis describes price movements in the financial market. Developed by Ralph Nelson Elliott, it observes.

Elliot Wave Analysis An Actionable Guide for Stock Traders

1,764 reviews on Quick link to content: 1. Elliott Wave 2. Elliott Wave principle 3. Elliott Wave examples 4. Elliott Wave corrective patterns 5. Elliott Wave fractals 6. How to start counting Elliott Wave 7. Elliott Wave theory rules 8. Limitations of the Elliott Wave theory 9. How to use Elliott Wave in trading Elliott Wave

Practical Application of Elliott Wave Theory in Trading R Blog

The books are written by experts familiar with the work flows, challenges, and demands of investment professionals who trade the markets, manage money, and analyze investments in their capacity of growing and protecting wealth, hedging risk, and generating revenue.

Understanding Elliott Wave Theory Basics And How To Apply Them

Examples might include housing prices, fashion trends or how many people choose to ride the subway each day. In this section, we will introduce the rules of wave formation and the various patterns seen in Elliott Wave Theory.

Elliot Wave Theory Explained on Example Video & Guide

Elliott Wave theory is a broad area of knowledge making it very difficult for beginners to know where to start!… This video is designed to kick off your Elli.